Content

Investing in a high-quality FX back office system is one of the most important decisions that any broker should make if he wants to improve efficiency, control risks, and be compliant with various regulations. The appropriate back office solution will help in optimizing the workflow reducing the cost of operations and enhancing quality service delivery to the clients. The brokers must analyze the market for their requirements and some of the crucial features to look for include compliance, integrations, and safety when sourcing for the best forex back office solution. LXLite by Leverate is a back office solution that provides client management, compliance, and payment Prime Brokerage processing features.

Forex Software Overview: Top Solutions for Brokers and Clients

It optimizes complex processes while providing a user-friendly interface, ensuring that every interaction is streamlined and effective. LXCRM allows you to efficiently categorise your client base according to various criteria, such as trading experience, activity level, and account type. This enables you to tailor marketing campaigns, personalise communication strategies, and provide targeted support to different forex trading mobile app client segments. Selecting an optimal CRM for Forex brokers is not an easy task, as businesses should consider numerous variables.

KYC stages (know your customer)

UpTrader also provides customizable reporting, which allows brokers to generate detailed analytics on customer activities, trading performance, and revenue metrics. Additionally, UpTrader’s multi-level access control makes it easy to delegate specific tasks to different departments while maintaining data security. For brokers seeking scalability, UpTrader offers modular options to customize features and functions according to their specific business needs, enabling the software to grow with the brokerage. UpTrader is a fast-emerging social trading solution known for its new technology and versatility in the https://www.xcritical.com/ forex market. It provides advanced copy trading and social trading tools designed for brokers, traders, and investors who need an easy trading experience. In this competitive Forex trading world, software makes the difference between winning and losing.

Introducing broker (IB) partner management

- MID-CO COMMODITIES, INC. is a professional price-risk management brokerage that offers market guidance to commercial elevators and producer accounts throughout the Midwest.

- From the forex platform software, CRM and analytics tools to reporting and compliance protocols, proper back office software handles every possible need for digital forex brokers.

- Brokers can register, store, and track users’ legal documentation required by regulatory authorities.

- Forex back-office software has been developed to streamline the operations of brokerages.

- Back office systems allow staff to verify clients’ identities and access their account activity easily.

- Cloud Forex CRM system empowers you to manage customer interactions, monitor trading activity, and generate insightful reports from a centralised, web-accessible platform.

Factors like the available budget, target audience preferences, and local competition will determine which services and tools you need most from the desired Forex CRM systems. This can be particularly beneficial for Forex brokers who value clear visualisation of their client acquisition process. Using a pipeline interface, Pipedrive allows you to track leads, deals, and client communication in a visually organised manner. Known for its user-friendly interface, Freshsales CRM caters well to growing Forex brokerages. Its intuitive design makes it easy for your team to learn and adapt, maximising its effectiveness.

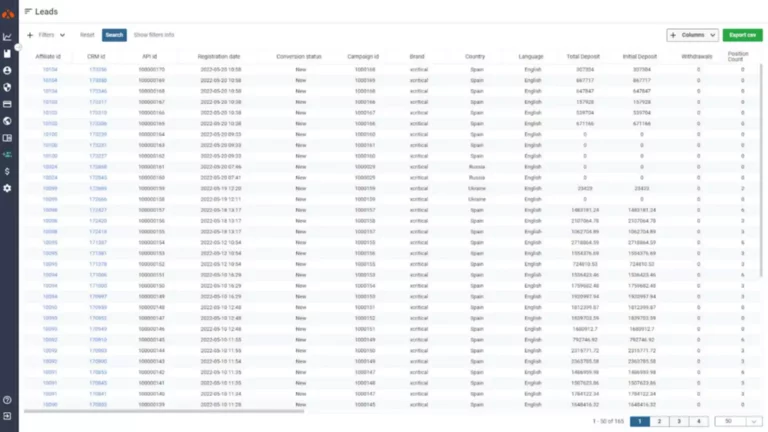

XCritical CRM and Social Trading

A Forex CRM system simplifies this process by automating calculations, showing transparent data for each client, and ensuring accurate rebate or payment splitting. Overall, Forex CRM is crucial for brokers aiming to enhance service quality, manage leads effectively, and achieve business expansion in the competitive Forex market. Essential for improved customer service and efficient lead management, Forex CRM automates routine tasks, freeing brokers to focus on strategic goals. Back-office trading software providers offer comprehensive services for online trading, saving time and money.

Prop Firm Solutions is a cutting-edge software suite custom-built for proprietary trading firms. This platform integrates an all-in-one solution for the operational needs across trader onboarding, performance monitoring, and execution. The benefits of this will include increased productivity, and accuracy, not to mention trader satisfaction; making it a terrific solution for prop firms who want to work smarter, not harder by the year 2025. This article discusses the features and benefits of Prop Firm Solutions, why prop trading CRM is indispensable, and how prop firm software is going to change the nature of proprietary trading in the year 2025. With UpTrader, brokers gain more than just software; they gain a partner committed to their success.

We support the trading, hedging, and asset management needs of a worldwide client base of institutions, corporations, foundations, family offices, and individual investors. Marex is a diversified global financial services platform, providing essential liquidity, market access and infrastructure services to clients in the energy, commodities and financial markets. With 29 offices, access to all major exchanges, and technology-powered data and advisory services, Marex is your essential partner. B2Core is a Forex CRM with progressive client cabinets and back-office software, utilising state-of-the-art technology for Forex and crypto businesses. It offers comprehensive statistics for brokers and Forex traders, supports referral programs, and offers top-notch security, including features like 2FA and KYC integration. Advanced compliance technology offers AI-driven risk assessment and predictive regulatory analysis.

The software should also track and record the actions of partners and other admins, allowing for a better understanding of business progress. This article will discuss the functionality of Forex Back Office Software, its advantages, and the top solutions available in the industry. The compliance and risk management system is one of the most essential components of the back-office. All major PSPs come pre-integrated to your system, which means your traders can use their favourite payment methods for deposits straight from the client portal, no matter where they are in the world.

This not only enhances client satisfaction but also encourages active participation in trading activities. However, on the other end, such software enables the client to effortlessly carry out trading, view market prices, and place trades accurately. Integrated with MetaTrader 4 and 5, it features a customer-centric Traders Room, a multi-tier IB/Affiliate system, and a branded mobile app. Ensure compliance, efficiently manage customer and IB data, and improve client retention with a superior digital experience.

The service desk is a customer service tool that allows FX brokers to better track and address inquiries. Users can create tickets and track updates on them, as well as add images and videos to improve resolution. B2B CRM allows brokers to improve their sales and after-sales activities, focusing on customer satisfaction and retention. This functionality includes automated communication styles and notifications according to clients’ activities.

Traders can utilise a secure online platform on the company’s website to conduct trades, process payments, and handle client documentation and identification requests. An Introducing Broker (IB) is an individual or firm whose main role is to introduce new clients to a forex brokerage and earn a commission on each trade made by the referred client in return. Besides the regular compliance and risk management tools, many brokerages invest heavily in dedicated KYC management tools.

Brokers take advantage of this feature to provide personalized services to their clientele. In a very competitive market such as that of forex, personalized services help you stand out and ensure success. Their comprehensive suite of systems is the ultimate resource for international forex brokerages all over the world. Tasks can beautomated, sales and marketing teams supported, documents can be stored andmonitored, promotional materials can be generated and reporting becomes amatter of a few clicks. The entire system was built with forex brokerages inmind, specifically how they have to interact with regulatory bodies. Our Push Notifications System is an integral feature of our CRM, allowing brokers to send notifications directly to clients without the need for additional third-party services.

Whichever your preference for social trading in forex or any other type of asset, here are the top platforms in 2024 for the trader. More platforms are being launched all the time to help traders as forex social trading becomes more popular. Below is a list of the top 10 social trading platforms from 2024 to help you navigate this exciting change. Each platform is special in its way, with different features, easy access, and community support. Social trading has become a huge portion of the financial industry, especially in 2024.

Forex broker CRM should streamline sales management by providing comprehensive customer information, including buying history, habits, and contact details. It should also track lead sources, enabling personalised approaches to each customer, ultimately positively impacting sales. This feature enables companies to track leads and improve their overall performance. In this article, we will discuss the role of Forex Back-office software in the market and provide some tips on selecting the best Forex CRM. It streamlines KYC processing and account opening and sends auto-reminders to chase incomplete document uploads. The software also tracks leads, increases trader engagement, automates back-office operations, speeds up compliance processes, and connects to multiple MetaTrader 4/5 servers.